Unlocking the Benefits of Futures Spread Trading: A Comprehensive Guide

In the world of trading, there are many strategies that traders can use to maximize their profits and minimize their risks. One of these strategies is futures spread trading, which involves the simultaneous buying and selling of two different futures contracts.

The objective of this strategy is to take advantage of price differences between two futures contracts, which is known as the spread. By buying and selling two different contracts, the trader can limit their exposure to overall market risk, as any change in the price of one contract will be offset by the opposite change in the other contract.

Furthermore, futures spread trading can also be used to exploit arbitrage opportunities when there is a discrepancy in the price of two similar contracts. For example, if the crude oil futures contract for delivery in September is trading at $50 per barrel and the contract for delivery in October is trading at $52 per barrel, the trader could sell the September contract and buy the October contract, expecting the prices to equalize in the future.

Another benefit of futures spread trading is that it can be used as a risk management strategy. For instance, if a trader has a long position in a corn futures contract and is concerned about a possible price drop, they could hedge their position by selling a corn futures contract for a later delivery. If the price of corn falls, the short position in the later delivery futures contract will offset the losses in the original long position.

With a solid understanding of the basics and advanced techniques, traders can unlock the many benefits of this trading strategy.

Futures Spread Trading: Discover the Profitability Potential

When it comes to trading futures, there are a variety of strategies that traders can use to maximize their profits. One of these strategies is futures spread trading, which involves simultaneously buying and selling two different futures contracts in order to profit from the difference in their prices.

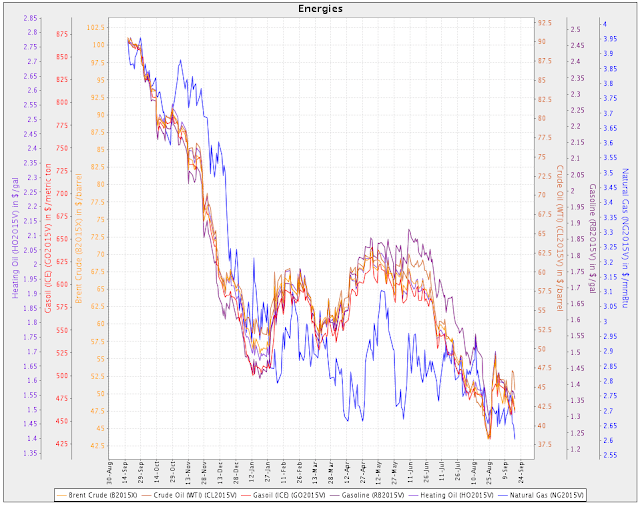

The basic idea behind futures spread trading is that traders can take advantage of the relationships between different futures contracts. For example, if a trader believes that the price of crude oil is going to rise, they might buy a futures contract for crude oil. However, if they also believe that the price of heating oil is going to rise, they might sell a futures contract for heating oil. By doing this, they can profit from the difference in the price movements of the two contracts.

The key to successful futures spread trading is to carefully analyze the relationships between different futures contracts. Traders need to consider a variety of factors, such as supply and demand, market trends, and geopolitical events, in order to determine which contracts are likely to move in opposite directions and which are likely to move in the same direction.

One of the main advantages of futures spread trading is that it can help to reduce risk compared to other futures trading strategies. By simultaneously buying and selling two contracts, traders can hedge their positions and limit their exposure to market volatility. Additionally, futures spread trading can be less capital-intensive than other strategies, as traders only need to put up a fraction of the total value of the contracts they are trading.

Overall, futures spread trading can be a highly profitable strategy for experienced futures traders who are willing to put in the time and effort to carefully analyze the markets. By taking advantage of the relationships between different futures contracts, traders can potentially earn significant profits while mitigating their risk exposure.

Discover the Benefits of Futures Spread Trading with Real-Life Examples

When it comes to futures trading, futures spread trading is a popular strategy among traders who want to reduce risk and increase profits. This involves simultaneously buying and selling futures contracts for different delivery months of the same commodity or related commodities.

One of the main benefits of futures spread trading is that it allows traders to hedge their positions, which means they can protect themselves against potential losses. For example, if a trader buys a futures contract for a commodity at a certain price, they can sell a futures contract for the same commodity at a higher price, which can help offset any losses if the price of the commodity decreases.

Another benefit of futures spread trading is that it can help traders capitalize on market inefficiencies. For instance, if the price of crude oil is expected to increase, a trader can buy a futures contract for crude oil for delivery in six months and sell a futures contract for crude oil for delivery in two months. This could potentially yield a profit if the price difference between the two contracts narrows over time.

Real-life examples of futures spread trading include the crack spread, which involves buying crude oil futures and selling gasoline and heating oil futures, and the calendar spread, which involves buying futures contracts for a certain commodity for one delivery month and selling futures contracts for the same commodity for another delivery month.

In conclusion, futures spread trading can be a valuable strategy for reducing risk and increasing profits in futures trading. By hedging positions and capitalizing on market inefficiencies, traders can potentially achieve success in this exciting and dynamic field.

Mastering Futures Spread Calculation: A Step-by-Step Guide

When it comes to futures spreads trading, understanding the calculations involved is crucial. The Mastering Futures Spread Calculation: A Step-by-Step Guide provides traders with an in-depth look at the process of calculating futures spreads.

What are Futures Spreads?

A futures spread is a trading strategy that involves simultaneously buying and selling two futures contracts. The goal of this strategy is to profit from the difference in price between the two contracts.

How to Calculate Futures Spreads?

Calculating futures spreads involves several steps. The first step is to determine the contracts that will be used in the spread. This is typically done by selecting two contracts that have a similar underlying asset.

The second step is to determine the spread price. This is done by subtracting the price of the lower contract from the price of the higher contract. The resulting number is the spread price.

The third step is to determine the spread value. This is done by multiplying the spread price by the size of the spread. The size of the spread is determined by the number of contracts being traded and the size of each contract.

Example of Calculating Futures Spreads

Let's say a trader wants to trade a spread between the December corn futures contract and the March corn futures contract. The December contract is trading at $4.50 per bushel, and the March contract is trading at $4.60 per bushel.

The spread price is calculated by subtracting the price of the December contract from the price of the March contract. In this case, the spread price is $0.10.

The spread value is calculated by multiplying the spread price by the size of the spread. Let's say the trader is trading 10 contracts of each contract size, which is 5,000 bushels per contract. The size of the spread is therefore 100,000 bushels. The spread value is calculated by multiplying the spread price of $0.10 by the size of the spread of 100,000 bushels. The spread value is therefore $10,000.

Conclusion

Mastering futures spread calculation is essential for traders who want to succeed in futures spreads trading. By following the steps outlined in the Mastering Futures Spread Calculation: A Step-by-Step Guide, traders can gain a better understanding of the calculations involved and make informed trading decisions.

No comments:

Post a Comment